b&o tax credit

When you use the MATC it eliminates the duplicate BO tax paid on goods. The MATC is also known as Schedule C.

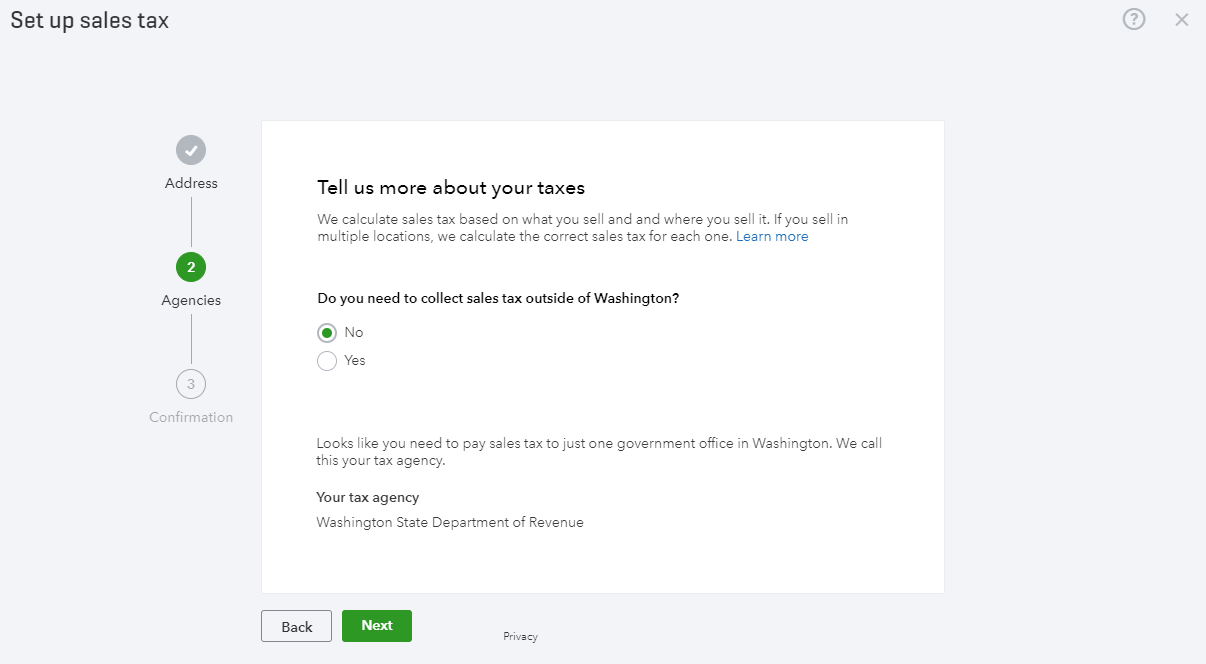

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Washington updated 6222020 Yes.

. You must mail or fax the Rural Area Application for New Employee BO Tax Credit within 90 days of filling the first qualified position. Youll only pay tax if you go above the annual allowance. Most Washington businesses fall under the 15 gross receipts tax rate.

The difference is that a gross receipts tax is levied upon the seller of goods or services while a sales tax is nominally levied upon the buyer although both are usually collected and paid to the. When paying the B O tax to the Department of Revenue you declare your income in different categories. A gross receipts tax or gross excise tax is a tax on the total gross revenues of a company regardless of their source.

Frustratingly a remote seller may find that registering in such a state for sales tax may have unintended consequences. Your annual allowance is the most you can save in your pension pots in a tax year 6 April to 5 April before you have to pay tax. The Retailing BO tax rate is 0471 percent 00471 of your gross receipts.

Washington states business and occupation BO tax is imposed on any business without physical presence in the state that has more than 100000 in combined gross receipts attributed to Washington. In this episode of the SALT Shaker Podcast policy series Eversheds Sutherland Partner and host Nikki Dobay welcomes Chris Wright Senior Vice President of Advance SFBefore getting into the weeds on San Franciscos tax landscape they cover the background of Advance SF and its mission to address issues that impact the ability of businesses and individuals to prosper in. The small business tax credit is broken up based on how often you file as follows.

SMC 538070 does not provide for an inflation adjustment for the deduction for the annual compensation of non-profit healthcare entities. 4000 BO tax credit for each qualified position created with annual wagesbenefits of more than 40000. If marketplace seller does owe Vermont use tax it is required to remit individually.

Basically you can take a credit against the Manufacturing BO tax in an amount equal to the Wholesaling or Retailing BO tax due on the selling activity. Yes if the marketplace seller has nexus requiring it to register and file returns for BO tax. A gross receipts tax is often compared to a sales tax.

71 for monthly taxpayers 211 for quarterly taxpayers and. No note that marketplace seller may owe Vermont use tax based on physical presence activities. SMC 538045 SMC 538070 provides for a CPI linked inflation adjustment for the amount of the dollar thresholds in SMC 538030 tax imposed and the amount of the exemption in SMC 538040A1 7 million prior year threshold.

B O tax rates.

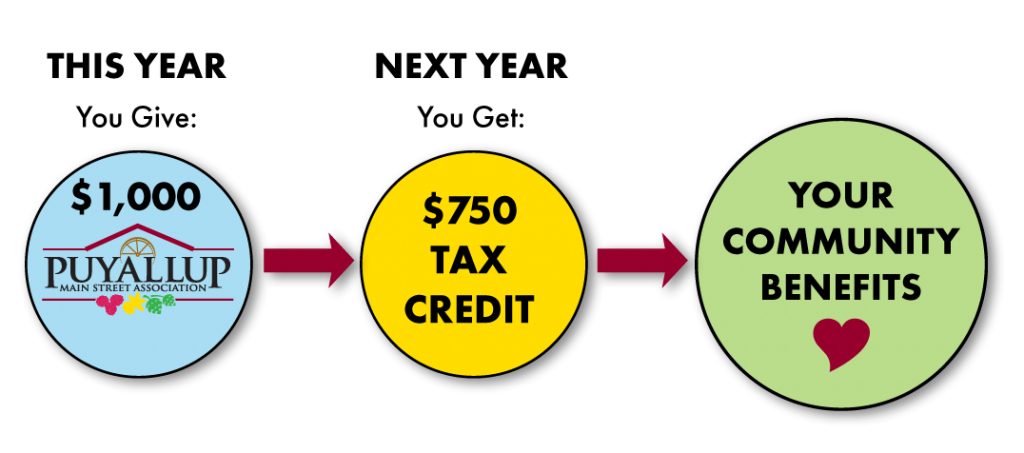

B O Tax Credit Program Sumner Main Street Association

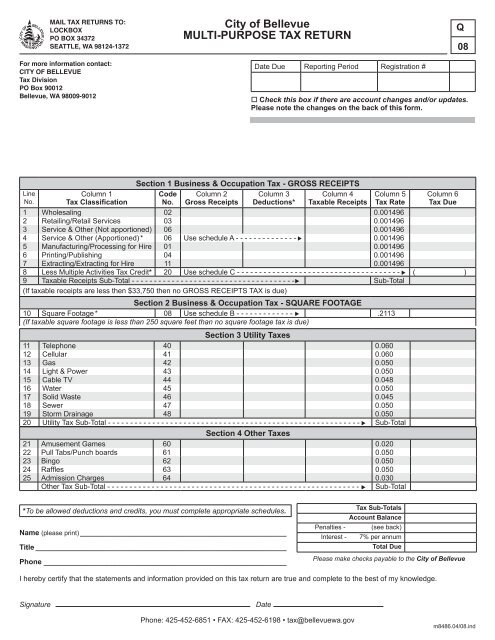

Quarterly Multi Purpose Tax Return City Of Bellevue

B O Tax Program Puyallup Main Street Association

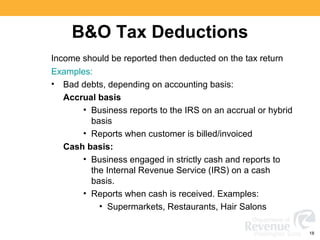

Washington State Sales Use And B O Tax Workshop

Washington State Sales Use And B O Tax Workshop

Washington State Sales Use And B O Tax Workshop

Main Street Tax Credit Program In Washington

Projects Programs Kent Downtown Partnership

9712 Fairbanks Morse H12 44 Baltimore And Ohio Railroad Train Photography Train

Business And Occupation B O Tax Washington State And City Of Bellingham

B O Tax Credit Incentive Program Downtown Waterfront

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Don T Miss The Washington State Tax Reconciliation Deadline

Small Business Thanks Governor For Signing B O Tax Credit Bill

B O Railroad Train Sign Heritage Logos Baltimore Ohio Etsy Canada

%20Taxes/bo-tax-header.jpg)